Driving real change in real estate

Europe’s largest value-add fund of €3.65bn raised

In the face of a challenging global fundraising environment, we’ve attracted unprecedented investor demand for our latest fund NSF V, making it the largest European focused value-add real estate fund to date, thanks to our proven strategies, pipeline, geographical focus and ESG leadership.

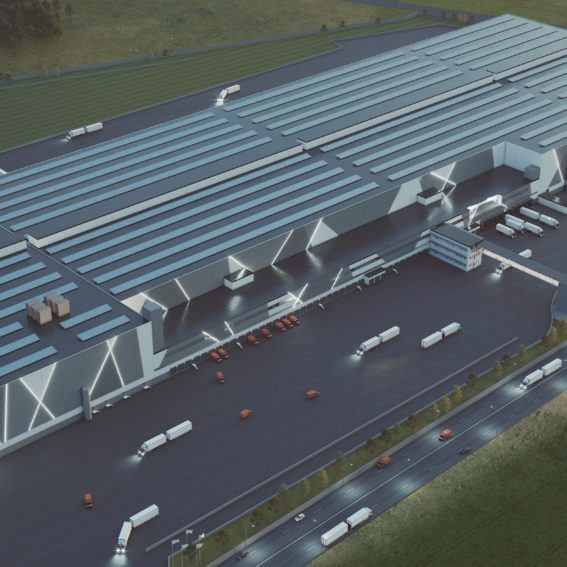

A selection of our work

Explore examples of Nrep’s real estate projects